Another important characteristic of cell loans is the availability of short-term borrowing choices.

Another important characteristic of cell loans is the availability of short-term borrowing choices. Whether it’s for sudden medical payments or urgent house repairs, the power to borrow small amounts for temporary durations can be a monetary lifesa

Advantages of Employee Loans

The main enchantment of worker loans lies in their accessibility and ease of use. For many staff, the standard loan course of can be daunting, filled with paperwork and long ready periods. In contrast, worker loans provide a streamlined course of that may typically be executed within hours or days. This speedy turnaround is particularly useful for staff facing urgent financial wa

Monthly loans are monetary instruments that provide people the capability to borrow funds and repay them over a predetermined time frame via scheduled monthly payments. They cater to a extensive range of monetary needs, from buying a home to financing a car or overlaying surprising bills. Understanding the intricacies of monthly loans can help borrowers make informed selections and handle their finances successfully. This article delves into what month-to-month loans are, their types, how they work, and important considerations for potential debtors, whereas additionally introducing a priceless useful resource for additional insig

Lastly, real estate is usually a priceless means of diversification in an investment portfolio. By including property as an asset class, traders can cut back total portfolio danger whereas gaining publicity to a market that usually behaves differently than shares and bonds. This balance can result in more stable long-term monetary progr

Secured vs. Unsecured Auto Loans: Secured auto loans are backed by the automobile you're purchasing,

이지론 whereas unsecured loans don't require collateral. Secured loans typically supply decrease interest rates for the rationale that lender has much less danger. However, if you default, the lender can seize the

Dealer Financing vs. Bank Loans: Dealer financing is commonly convenient and may be fast, allowing you to drive off the lot with your new car. However, bank loans could offer more favorable phrases and decrease interest rates, making them a viable option to consi

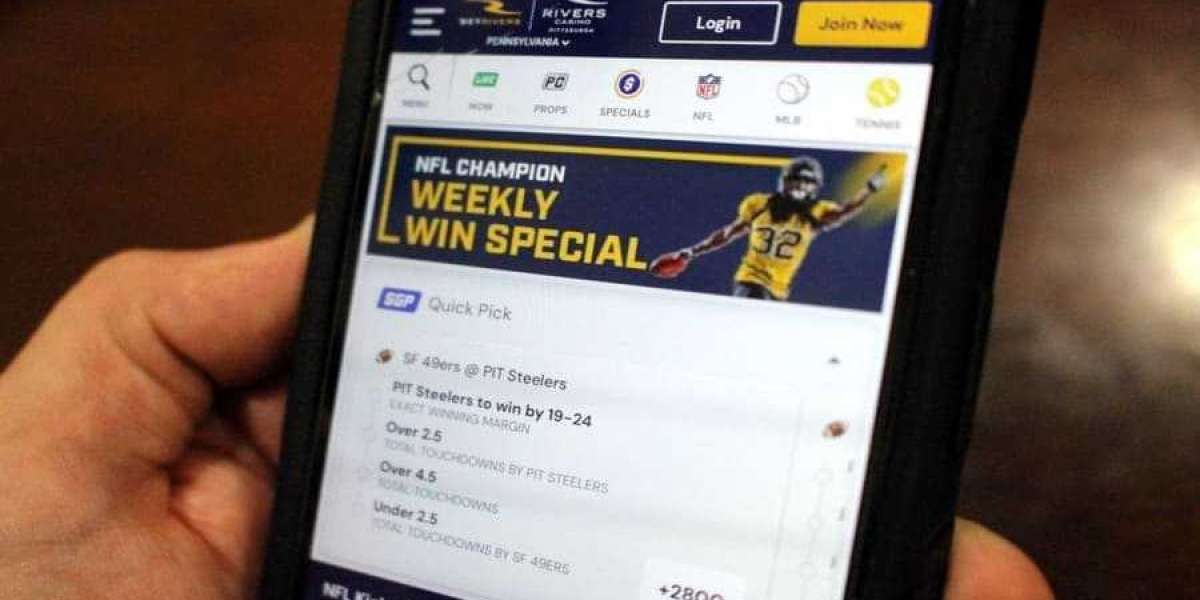

Choosing the proper cell mortgage supplier involves researching numerous options. Look for lenders with competitive interest rates, clear phrases, and constructive buyer reviews. Comparing a number of lenders on platforms like BePik can enhance your understanding and assist you to make an knowledgeable choice based mostly on your monetary scena

Moreover, Beppik options comparisons of mortgage products, which can help homemakers find probably the most favorable phrases based mostly on their specific monetary state of affairs. The website emphasizes user-friendliness, making it accessible to people who will not be financially sa

Another very important facet of auto loans is the rate of interest, which might differ based in your credit score score, the type of car, and the lender's standards. Having a great credit rating usually lets you qualify for decrease charges, thereby saving you cash in the lengthy

1. Interest Rates: The interest rate on the mortgage is a important issue that determines the overall value of the loan. Borrowers ought to store round for the most effective rates and contemplate mounted vs. variable rates of inter

Eligibility for an actual estate

Loan for Credit Card Holders usually is dependent upon elements such as credit score score, employment history, earnings stage, and debt-to-income ratio. Lenders normally require a minimum credit rating, usually round 620 for standard loans. A regular job and earnings showcase your capacity to repay the mortgage whereas a lower debt-to-income ratio is favorable when assessing your financial hea

Moreover, relying closely on loans can lead to a cycle of debt that may have an result on financial stability in the long term. It’s vital for homemakers to weigh their choices carefully and keep away from overextending themselves financia

The BePick website options an easy-to-navigate interface that enables users to filter mortgage choices based mostly on specific criteria, including interest rates, compensation phrases, and lender status. This function simplifies the decision-making process, making it simpler for you to discover a mortgage that meets your unique monetary situat

It’s important for debtors to know that the entire cost of the mortgage includes both the principal and the interest paid over the lifetime of the mortgage. Using tools like mortgage calculators might help estimate month-to-month funds and total mortgage prices based on different situati

How to Qualify for a Housewife Loan

Eligibility for a Housewife Loan varies by lender, however there are a few widespread standards. Most lenders will take a glance at family income, which may include a companion's salary or different sources of revenue, similar to hire or investments. Providing documents that detail family finances can strengthen the applicat

Как возможно недорого заказать диплом в онлайн-магазине

By sonnick84

Как возможно недорого заказать диплом в онлайн-магазине

By sonnick84 Torchlight: Infinite Beginner's Guide – Everything You Need to Know - IGmeet Ways

Torchlight: Infinite Beginner's Guide – Everything You Need to Know - IGmeet Ways

Интернет-магазин, в котором возможно заказать диплом университета

By sonnick84

Интернет-магазин, в котором возможно заказать диплом университета

By sonnick84 Советы эксперта, которые дадут возможность быстро заказать документы

By sonnick84

Советы эксперта, которые дадут возможность быстро заказать документы

By sonnick84 Where can I find a wide range of diplomas from Russian universities?

By sonnick84

Where can I find a wide range of diplomas from Russian universities?

By sonnick84